Dacotah Bank and Dakota Resources Connect Capital and Shared Values to Impact Rural Communities

When it comes to investing in rural communities, Dakota Resources is only as strong as our partner organizations, including our major investors. Our ability to connect capital and capacity to rural communities in their work to thrive is directly related to the financial investment of organizations who not only desire to make an impact in cultivating a thriving rural, but who also make it possible for us, as a certified CDFI, to then offer capital assistance to communities and organizations in need.

We’re grateful for a long-lasting and impactful relationship with Dacotah Bank, one of the original investors in Dakota Resources’ loan fund. Our shared goals work in tandem for the overall benefit of rural communities. To date, Dacotah Bank has invested and sponsored over $2.8 million in our mission.

Here’s how it works: investors, like Dacotah Bank, who believe in the work of Dakota Resources – and in the power of rural communities – pool their capital into our loan fund. Then, Dakota Resources is able to re-lend that money to rural economic development organizations, housing authorities, and other CDFIs to support a variety of rural initiatives.

Additionally, many banks who invest in Dakota Resources, including Dacotah Bank, do so in order to meet the requirement by the federal Community Reinvestment Act to reinvest part of their profits into local communities.

Beyond that, however, Joe Bartmann, President of Dakota Resources, points to the shared values that exist between investors like Dacotah Bank and Dakota Resources.

“Investors like Dacotah Bank want to help the rural communities they serve to thrive, and they believe partnering with us is one effective way to do that because they align with our values and approach,” Bartmann said. “Most see our capital pool as a way to join together with other investors to leverage their community development dollars while also supporting Dakota Resources in our mission to connect capital and capacity to empower rural communities. And since we’re a certified CDFI, they can be confident that investing in our mission will help them to help rural communities they care about.”

Partnering with Dakota Resources in this way also benefits the rural organizations who borrow from our fund. The loans are structured to be very flexible, so that the economic development organizations can use the money to make local projects happen in a way that is best for their community. This form of financing also does not require collateral, which offers additional flexibility for borrowers.

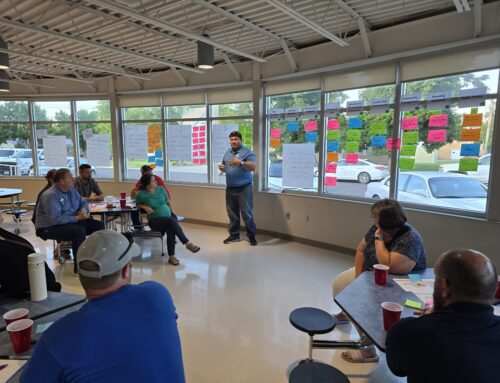

Dacotah Bank employees support rural communities in a variety of ways.

Another benefit, made possible by capital investors like Dacotah Bank, is that the capital is accessible and affordable. Borrowers only pay interest payments until the loan matures, and at the maturity date of their loan (which is typically a five-year or ten-year term), organizations have the option to pay back the full loan amount or to apply for a renewal.

Bartmann also credits Dacotah Bank for their support and engagement beyond the actual dollars and cents.

“Dacotah Bank has supported our mission in so many ways, including financially,” Bartmann said. “Beyond that, they’ve also engaged as volunteer leaders on our board and have functioned in other advising capacities on an ongoing basis.”

The impact of such a partnership is also beneficial for Dacotah Bank. According to David J. Sandvig, Senior Vice President and Chief Strategy Officer for Dacotah Bank, their organization is celebrating 60 years this summer, and when it comes to the bank’s four main constituencies at the core of their purpose for service, a working relationship with Dakota Resources just makes sense.

“Since we began, our purpose for service includes the following: to empower employees, satisfy customers, enhance value for shareholders and, in line with what Dakota Resources is focused on, make a meaningful impact in our communities,” Sandvig said. “Our missions align so well it has just made sense to serve as a resource of people and capital for Dakota Resources as they work to impact our communities in positive ways. As Dakota Resources says, ‘we are better together,’ and we look forward to seeing their work continue to positively impact our state, businesses, communities and families.”

Interested in supporting our mission to connect capital and capacity to empower rural communities through an investment in our Capital Investment Fund? Learn how by clicking here.