Capital Investment Fund Connects Capital to Communities Ready to Make an Impact

Economic development is central to cultivating a thriving rural. In order for rural America to grow effectively and meaningfully, financial programs need to be flexible enough to meet organizations and agencies where they are and robust enough to truly support these entities in moving their community forward.

Together with our investors, Dakota Resources’ Community Development Loan program, and specifically the Capital Investment Fund, have supported a variety of borrowers in their work to build thriving rural communities (take a look at a list of our current investors here), and the program’s capital and capacity to support YOU continues to grow.

Who We Serve

We often hear from our borrowers that it can be challenging to find flexible loans to complete their organization’s projects. We fund organizations, not specific projects, by making loans to rural economic development organizations, housing authorities, and other Community Development Financial Institutions (CDFIs).

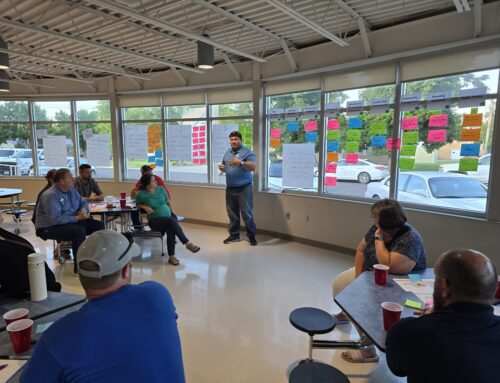

By connecting capital from regional investors with communities and organizations who are ready to make an economic impact, we equip and expand what’s possible in your community.

How Funding Works

The Capital Investment Fund’s flexible terms (interest-only payments for up to 10 years with no collateral required) and fast, easy, and free application process allow you as a leader in your organization or community to determine the best way to move your work forward with our team by your side.

After completing your application, our Director of Community Lending, Terri LaBrie, will begin working with you to gather your financial information and get you pre-approved for a specific loan amount if you qualify. Once you have that pre-approval, you can draw down on the funds anytime within a one-year period.

“The benefit of this program is the flexibility,” LaBrie says. “Rural communities can utilize our financing program for any project that fits our mission of community or economic development. Additionally, in most cases, we do not take security on the loan. With no collateral and the flexibility with projects, in addition to the interest-only repayment option, this program is ideal for communities that have the capacity to borrow funds.”

Why This Program Matters

Dakota Resources’ Capital Investment Fund’s loans are designed to be as unique as your goals are.

Our borrowers have used their loans for things such as housing development, infrastructure development, revolving loan funds, industrial site certifications, and community facilities, to name a few. You can also read some of our recent borrower stories from below.

Far from the Chicken and the Egg: Communities Investing in Rural Housing

Connecting Ideas to Capital: Business Incubator Thrives

Downtown Watertown Finds New Life

As for LaBrie, Dakota Resources’ Director of Community Lending, assisting borrowers as part of this program is fulfilling work.

“I love to visit with local economic developers and see first-hand what they do every day to benefit their communities,” LaBrie said. “If Dakota Resources can help them get their projects off the ground with flexible financing options, that’s rewarding.”

TAKE ACTION: If you’re interested in learning more about our Community Development Loans program and how we can help make your projects a reality, schedule a time to connect with our Director of Community Lending, Terri LaBrie. She can be reached here.